A frequently asked question by CAMICO policyholders is, “What should our policy limit be?” This is not an easy question to answer, which may explain why it is asked often.

The answer to the question requires a careful consideration of a variety of factors that run the gamut from the relatively well defined, such as regulatory requirements, to the more subjective, such as the “sleep well at night” factor.

Some factors are easy to understand, as are the dangers of being under-insured and over-exposed to liability, while others are not so easy, such as the perils of being over-insured and creating a target for unwarranted litigation.

A thorough consideration of the factors involved should ultimately lead to well-informed choices that best suit your firm’s requirements. While the following presents a general discussion of the considerations, you should discuss your situation with your insurance agent or underwriter.

How much is enough?

When considering the areas described in the following, keep in mind that your policy limit serves two purposes: to cover damages from an error committed by the firm in providing professional services; and to protect the assets of the firm and its owners from the financial consequences of a claim by using the insurance protection mechanism.

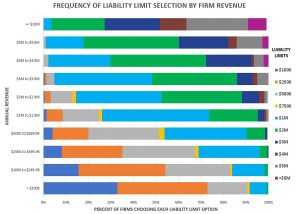

1. Annual firm revenue. This amount is a good starting point in considering how much protection your firm should have. CAMICO’s data on the limits chosen by approximately 8,000 policyholder firms is presented in the table below for comparison purposes. The table shows the distribution of per-claim policy limits selected by insured firms according to their annual revenue range.

2. Regulatory requirements. If you are practicing in an entity form such as an Accountancy Corporation, Limited Liability Corporation (LLC) or Limited Liability Partnership (LLP), you may be required to carry certain limits of liability insurance in order to qualify as an entity that will receive limited liability legal protections. The regulations for such entities can vary by state, so firms will need to ascertain which regulations apply to their entity form.

3. Risk exposures from services. The types of services offered by your firm, and the risks posed by them, can affect the size and types of limits you should have, especially when it comes to the question of single versus split limits.

4. Risk exposures from clients. The severity of a claim is closely related to the size of the client. Look closely at the kind of clients you have. If you have one or more high-net-worth clients, consider the amount of damages that may be claimed by such a client as a result of an error or omission. A firm with lower-net-worth clients will have less of a risk exposure. Another example would be an audit client that has significant lines of credit or loans to the business. Also, certain types of industries pose higher risk than others. For example, real estate, construction, financial industries, and any limited partnerships, public offerings, buy-sell transactions, or investment activities have more severe claims.

5. Firm and partner assets. Theoretically, adjudicated liability in excess of the policy limits may expose the firm and/or its partners to claim amounts not covered by your policy. However, in CAMICO’s experience there have only been a handful of claims where payments to the plaintiffs have exceeded policy limits. Generally, as long as the policy limit is sufficient, relative to the net worth that can legally be reached, plaintiffs will accept the amount available under the policy. CAMICO is not an advocate for “buy as much as you can afford.” The size of the limit can unfortunately motivate plaintiffs to exaggerate their damages and make it harder to negotiate a reasonable settlement. The best size is neither too big nor too small.

6. The “sleep well at night” factor. The firm needs to decide how to best manage its risks to be within its risk appetite. This involves a combination of loss prevention and risk management programs in addition to insurance coverage. Some firms and their partners are comfortable with the adequacy of their risk management abilities and procedures, which may lead them toward lower policy limits. Others are less comfortable about their ability to manage their own risks, which may lead them to choose higher policy limits.