No one likes to think about it, but as we age, some of us will become critically ill or injured, and some of us will experience a long-term disability or even have family emergencies or obligations. This is where practice continuation planning is important.

Visit http://www.camico.com/blog/Practice-Continuation-for-Small-Accounting-Firms

to learn more about additional resources utilized by our policyholders

Consider what would happen to your clients in such a scenario. When a client needs attestation services to obtain financing or satisfy loan covenants, or another client needs to have a tax return prepared by a certain deadline, who will complete the work?

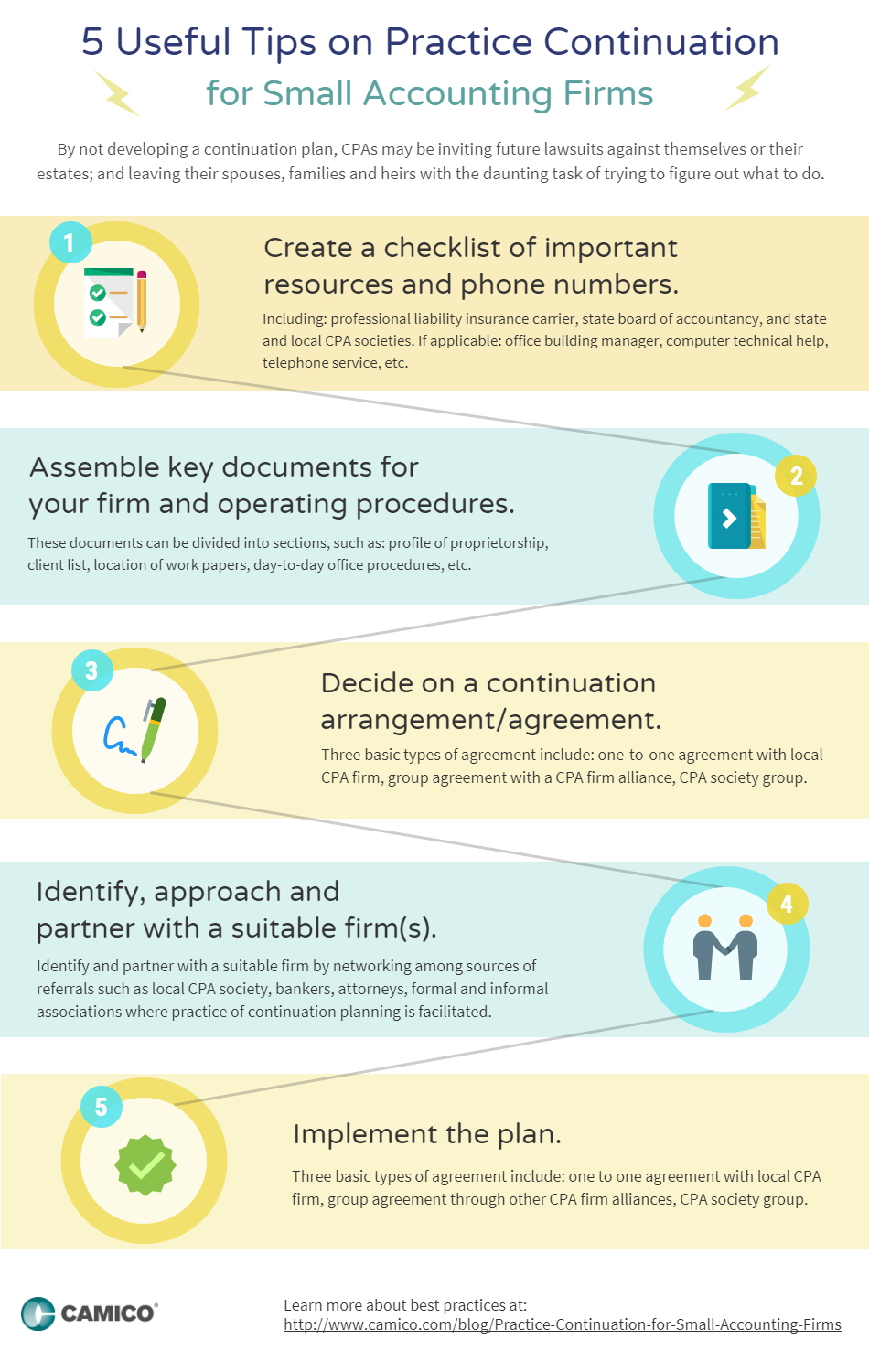

Potentially negative effects, such as missed opportunities or damage to a client’s business, are risk exposures that can come into play when a CPA becomes ill or disabled. CPAs who have not yet taken the time to develop a continuation plan may be:

- inviting future lawsuits against themselves or their estates; and

- leaving their spouses, families and heirs with the daunting task of trying to figure out what to do.

Create a checklist of important resources and phone numbers,

such as your professional liability insurance carrier, state board of accountancy, and your state and local CPA societies. Other important resources may include your office building manager, computer technical help, telephone service, and other utilities.

Assemble a set of practice and operating documents.

These documents can be divided into sections, such as:

- A profile of the proprietorship, including types of services offered, names of key employees, location of accounting records, bank account information, and location of contracts and lease agreements. :

- A client list, including key contacts, services provided and important deadlines. (This will need to be much more detailed if you are interested in the option of negotiating a buy/sell agreement as part of a contingency plan.) :

- Procedures used to monitor work in progress. This will enable others to determine the status of uncompleted work. :

- A guide to using the firm’s computers. :

- Location of work papers. :

- Description of filing system. :

- Office procedures for handling the receipt and return of client information. :

- Billing schedules and collection policies. :

- Procedures for identifying and paying accounts payable. :

- Location of personnel files. :

Decide on a continuation arrangement/agreement.

There are three basic types:

- A one-to-one agreement with a local CPA firm that you have identified as a good fit/culture for your firm. The agreement established between the firms should cover the critical areas that are necessary to ensure a smooth transition (both short-term and long-term) if it becomes necessary. The agreement usually has a buy/sell component with a clear formula for calculating the sales price of the firm, along with payment period and terms in the event of the CPA’s permanent disability or death.

- A group agreement, in which several CPAs may act as successors/partners to each other’s firms. CPA firm alliances or associations generally serve this purpose, among other purposes.

- A CPA society group that will assist the member, spouse or heirs in finding a successor/partner.

- Define the circumstances under which assistance will be triggered (e.g., long-term or permanent disability, or leave of absence).

- Specify a temporary timeframe. If the agreement addresses temporary disability versus permanent disability, definitions of the covered disabilities under the agreement should be included. Other applicable provisions, including client transition requirements, should also be addressed in the event that a permanent replacement of the CPA who is unable to work is required. Keep in mind, though, that people can be disabled for several months and still make a return to full-time work. Therefore, you might want to consider also including a buy-back provision in the agreement.

- Specify responsibilities to be performed by the assisting party, including financial terms or compensation for assistance, and provisions for billing, collection, record retention, confidentiality, and non-compete and restrictive covenants.

Identify, approach and partner with a suitable firm(s).

Implement the plan.

The best time to plan for a crisis is before it happens. By putting a practice continuation arrangement / agreement (PCA) in place, CPAs are taking steps toward future security. A practice continuation arrangement enables another CPA or CPA firm to step in for a CPA firm in the event of a death, temporary or permanent disability, or leave of absence. These arrangements are critical for smaller firms, especially sole practitioners, so employees and clients know what will happen or what will be communicated.

Here are 5 useful tips on practice continuation and how to get a plan started:

A variety of elements can be addressed in a practice continuation agreement, providing for a number of conditions and terms. It’s prudent to consult with an attorney when drafting a formal agreement or contract. A formal agreement can:

Network among sources of referrals. The best organization for such networking is often the local CPA society. Other sources include bankers, attorneys, and community groups. Alliances among CPA firms are active in some regions. Some are formal associations, others informal, but one of the benefits is that they can help facilitate practice continuation planning.

Some CPA sole practitioner groups will regularly meet to discuss their businesses and get to know each other. Some groups work together over a period of many years, enabling members to develop a high level of trust with each other and with their firms’ employees in case one of the CPAs needs to temporarily take over for another.

Practical matters are also covered during the meetings, such as office procedures, billing rates, records, passwords, and other important details. Practices that have certain niches or practice specialties will need a potential replacement CPA to have similar competencies, which may include special licenses. Another factor is whether the replacement CPA will be able to dedicate enough time to performing the role that the absent CPA performed.

Some groups strategize business plans for the next five or 10 years, asking each other what they can do to make things better for their clients and themselves. In the event of a long-term disability or death, the members can act as an agent for the other’s business and help spouses negotiate what to do with the practice. The planning process can also address retirements, exit strategies, buy-sell agreements, and firm succession in case CPAs need to leave their practice altogether for health or other reasons.

Contact your attorney to draft any agreements required by the plan. Discuss the plan with your spouse and successor/partner. Communicate in writing the instructions for all parties, and set up dates for annual reviews of the plan.

The worst time to craft notifications to clients is during a crisis. Prepare template notifications to clients and referral sources ahead of time. There’s a chance that the CPA being replaced will not be available for guidance during a crisis, so the CPA who is stepping in should be well apprised of as much information as possible.

Learn more about best practices for accountants at: www.camico.com/blog