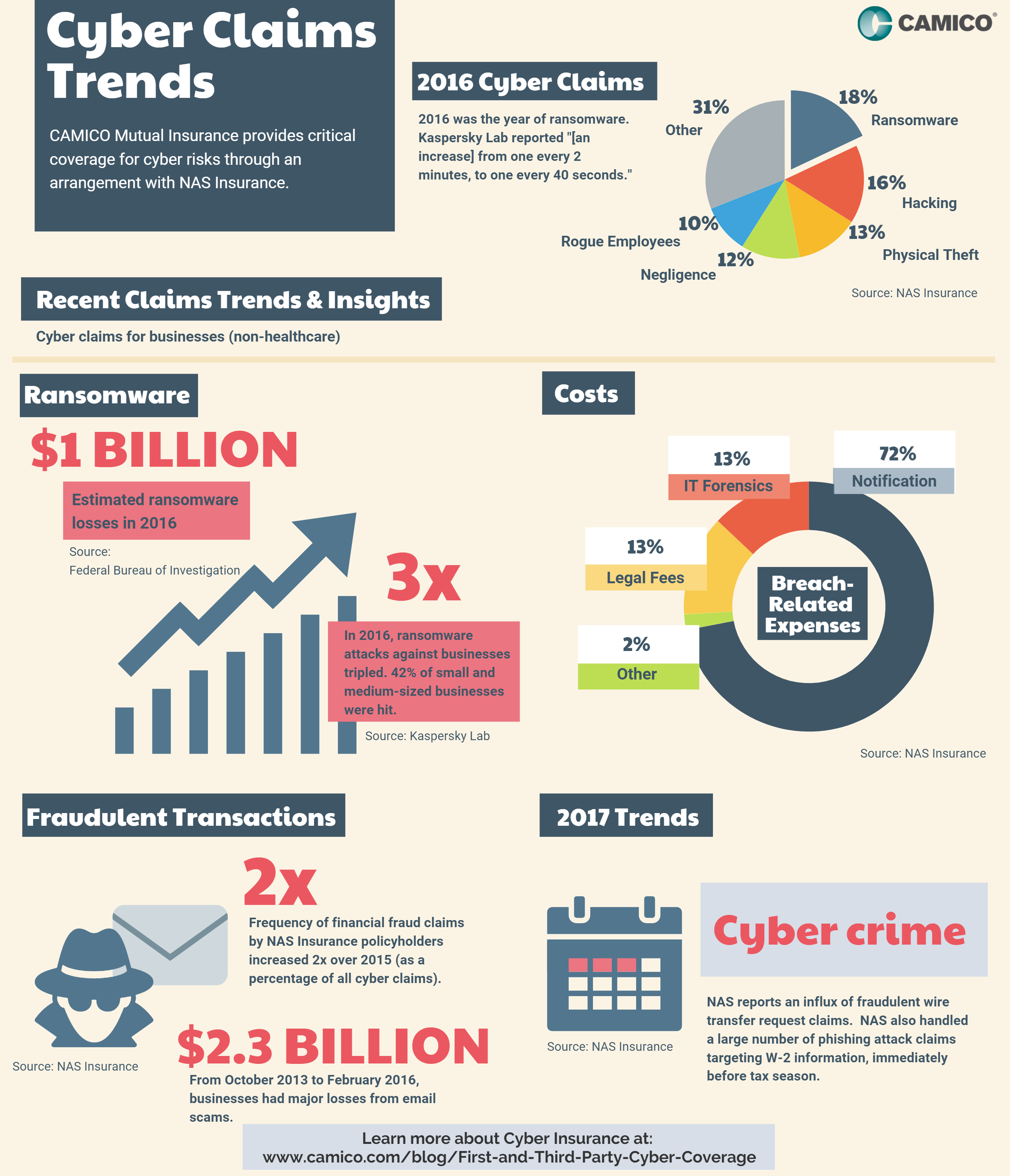

Cyber claims trends have increased over the past year. CAMICO Mutual Insurance provides critical cyber coverage to accountants for cyber risks through an arrangement with NAS Insurance and explains the update on current cyber claims trends below.

2016 Cyber Claims

2016 was the year of ransomware, with “[an increase] from one every 2 minutes, to one every 40 seconds.” The top 6 causes of data breaches can be categorized as ransomware, hacking, physical theft, negligence, rogue employees, and other. The types of cyber claims in 2016 are as follows:

- 18% Ransomware

- 16% Hacking

- 13% Physical Theft

- 12% Negligence

- 10% Rogue Employee

- 31% Other

Recent Claims Trends & Insights

Here are some quick and brief highlights of cyber claims for businesses (non-healthcare, including accounting firms).

Ransomware

- $1 billion: Estimated ransomware losses in 2016

- 3x: In 2016, ransomware attacks against businesses tripled. 42% of small and medium-sized businesses were hit.

Costs

Based on the previous year’s data, the breach-related expenses breakdown into 3 main categorizes: notification, legal fees, and IT forensics. Notification is the cost to notify customers of a breach. Legal fees are on-going legal costs, fines, and penalties, etc. IT Forensics is the cost to investigate what kind of cyber attack occurred and what was potentially stolen or hacked. With the rise of ransomeware and fraud activities, IT forsenic costs will increase this year.

- 72% Notification

- 13% Legal Fees

- 13% IT Forensics

Fraudulent Transactions

- 8x: Financial fraud claims by NAS Insurance policyholders increased 8x over 2015.

- $2.3 billion: from October 2013 to February 2016, businesses had major losses from email scams.

2017 Cyber Claims Trends

Cybercrime in the first quarter of 2017

- NAS reports an influx of fraudulent wire transfer request claims. NAS also handled a large number of phishing attack claims targeting W-2 information, immediately before tax season. More accountants have become victims of phishing attacks during tax season.

To learn more about how you can protect yourself through CAMICO’s Cyber Coverage click here .

Source: NAS Insurance