Economic conditions historically have a significant impact on CPA professional liability claims. When the economy is doing well, and businesses are relatively flush with money, people are less likely to notice funds missing. Fraud therefore tends to flourish and go undetected in good times.

When the economy takes a downturn, capital starts to become more precious, people look more closely at accounts, and missing funds are more often detected. In general, there are more claims and larger claims reported in an economic downturn.

Further, the longer fraudulent activities last, the more financial damage they cause. With the current economic expansion lasting more than 10 years, beginning in June 2009, the potential for many cases of yet undetected fraud may be significant—all the more reason to help clients reduce their exposures sooner than later.

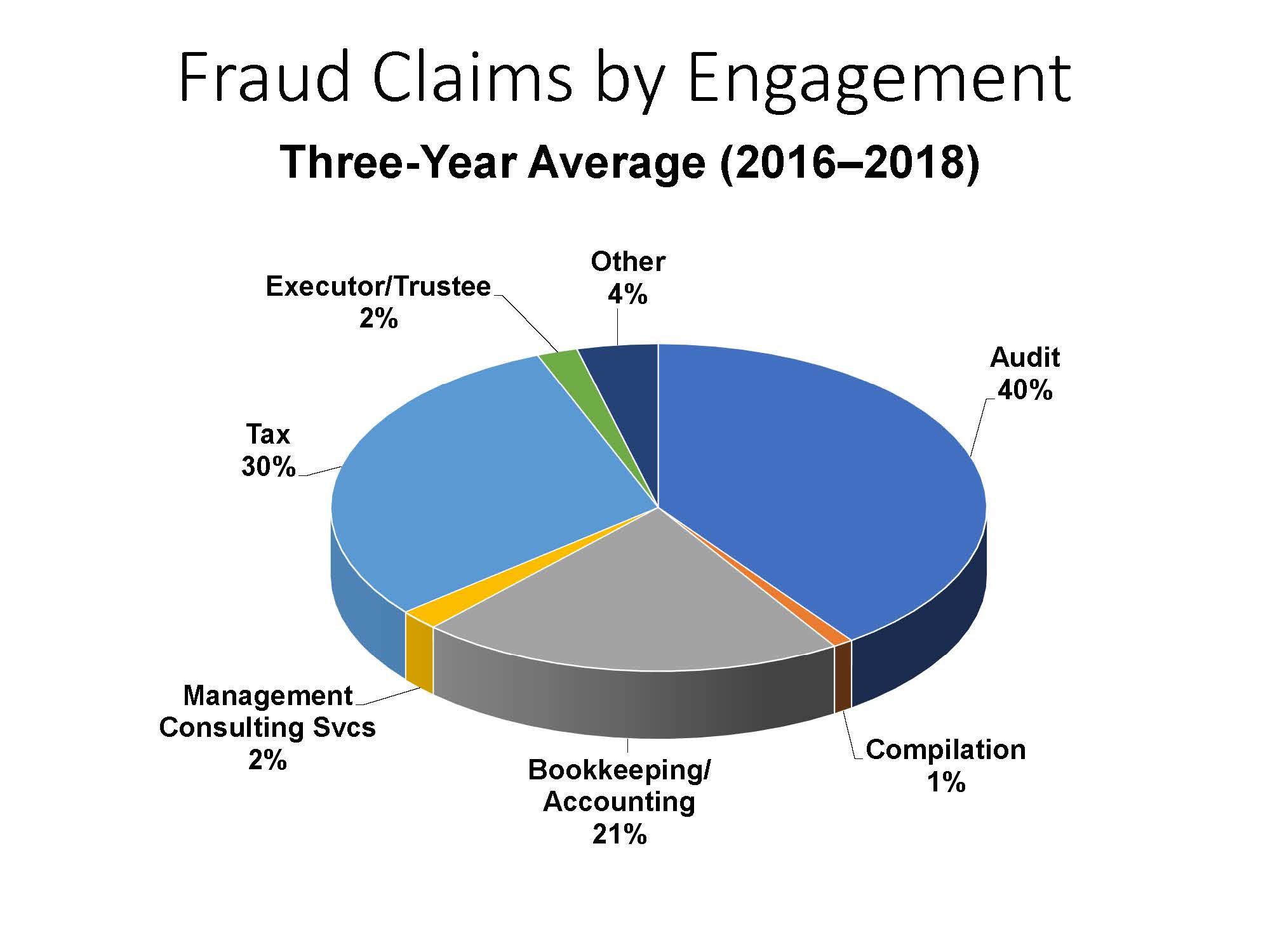

CAMICO claims experience also consistently shows that fraud claims occur in a wide range of engagement types, not just in attest engagements, as illustrated by the following chart on “Fraud Claims by Engagement.”

Tax and bookkeeping/accounting engagements account for 51 percent of fraud claims.

To learn more about the red flags of fraud and loss prevention advice, click here to download the entire article.