When looking for an insurance carrier, CPA (accounting) firms usually compare coverage and price to determine the “best deal.” But there is more to be saved than just premium. That is why you should also consider which insurance program gives you the best value and return on your premium. There are several areas where CAMICO® services and resources yield significant savings for policyholders.

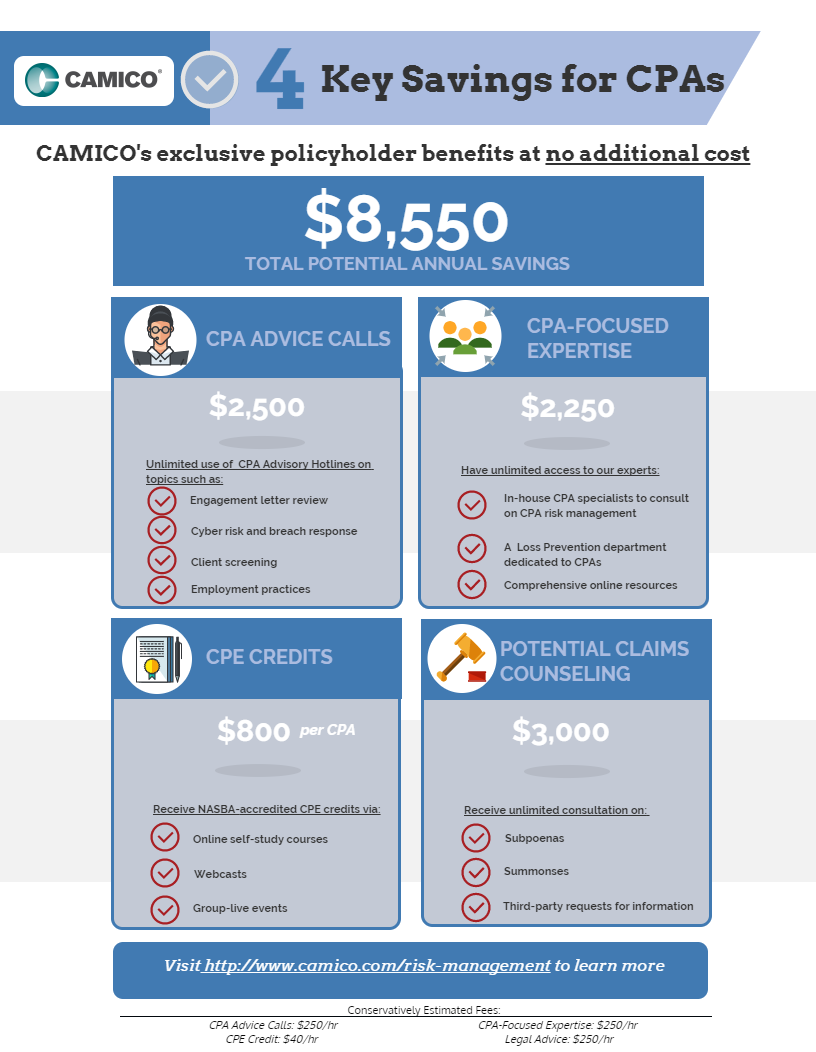

In the following examples, CAMICO’s exclusive policyholder benefits– at no additional cost– can potentially total $8,550 in savings per year.

Visit www.camico.com/risk-management

to learn more about additional resources utilized by our policyholders

1.CPA ADVICE CALLS: $2,500

- CAMICO policyholders have unlimited use of hotlines for advice on a wide variety of practice and risk management areas, including client screening, engagement and disengagement letter review, billing and collections, documentation, internal controls, as well as other key practice areas of concern for CPAs (accountants) today. We also offer a dedicated Tax Advice hotline and an Accounting & Auditing hotline to answer your questions about SSARSs, conflict of interest, ethics, and more. Our Loss Prevention specialists consult on about 7,400 phone calls per year from policyholders seeking guidance on risk management issues.

- Consider: The estimated cost to review an engagement letter could range between $150 and $350. Such services from CAMICO are provided at no additional cost and can result in significant annual savings for your firm and proactively avoid potential misunderstandings or miscommunication with your client.

- CAMICO offers free guidance and advice on variety of topics, including federal tax issues and potential problems associated with high-risk corporate, estate, and gift tax work. There are two types of services. We will review your firm’s fully researched tax treatment of a given transaction to help you determine tax issues and provide guidance on those issues. Alternatively, we will assist you in determining the tax issues presented by your particular fact pattern and discuss applicable tax research materials that can serve as a springboard for further research by your firm.

- Consider: Nine hours of advisory help from a tax attorney or specialist at a conservative rate of $250 per hour would save you $2,250. Gain access to specialists at no additional cost and resolve challenges you face in your day to day work.

- As part of our risk management program, CAMICO offers educational programs to all policyholders. Firms with 40 or more participants qualify for free in-firm CPE presentations that can be tailored to meet the specific needs of the group. CAMICO also offers approximately 20 free CPE credits or more a year, through webcasts and online self-study courses. For firms who don’t meet the 40-participant requirement, we are happy to schedule a free webcast specifically for your firm.

- Consider: A two-hour event, organized by an external CPE provider at a conservative rate of $40 per hour, would cost a firm with 40 participants $3,200, not considering lost billable hours traveling (hotel and airfare) if the event is held offsite.

- CAMICO’s experienced specialists provide counseling on potential claims to avoid a claim or reduce its impact. CAMICO encourages policyholders to notify us of potential claims situations as early as possible. Early reporting may qualify policyholders for a reduction in deductible, and potential claims expenses do not affect the policyholder’s deductible or limit. Our Claims department handles nearly 2,000 phone calls per year on potential claims matters.

- In the event a matter turns into a claim, CAMICO is with you every step of the way. Our claims specialists will guide you through the process and will develop a plan of action to resolve the matter efficiently and equitably.

- Consider: Outside counsel would have cost between $2,000 and $5,000 for services provided at no charge by CAMICO. You may be able to resolve a potential claim without having it become a claim. CAMICO provides 50% reduction in deductible (up to $50,000) for early reporting of a potential claim during the policy period in which it becomes known.

- CPA (Accountants) Advice Calls: $250/hr

- CPA-Focused Expertise: $250/hr

- CPE Credit: $40/hr

- Legal Advice: $250/hr

2.CPA-FOCUSED EXPERTISE: $2,250

3. CPE CREDITS: $800 per CPA

4. POTENTIAL CLAIMS & LEGAL COUNSELING: $3,000

Visit www.camico.com/risk-management to learn more about additional resources utilized by our policyholders

Conservatively estimated fee: